Fair Appraisals, Faster Inspections After Storms

Why Post-Storm Claims Require Speed and Precision

After a significant storm, insurance carriers are flooded with claims. Adjusters are on the move. Policyholders want answers. And timelines shrink under the weight of demand.

In these high-pressure moments, two things matter most: speed and fairness. Insurance carriers must deliver fast property damage assessments—but without sacrificing accuracy or opening the door to disputes. This is where the balance between faster inspections and fair appraisals becomes critical.

Faster Doesn’t Mean Rushed,

It Means Ready

Storm season isn’t a surprise. Yet many claims teams find themselves overwhelmed by volume. That’s often because initial inspections are either delayed or too basic to support the full claim.

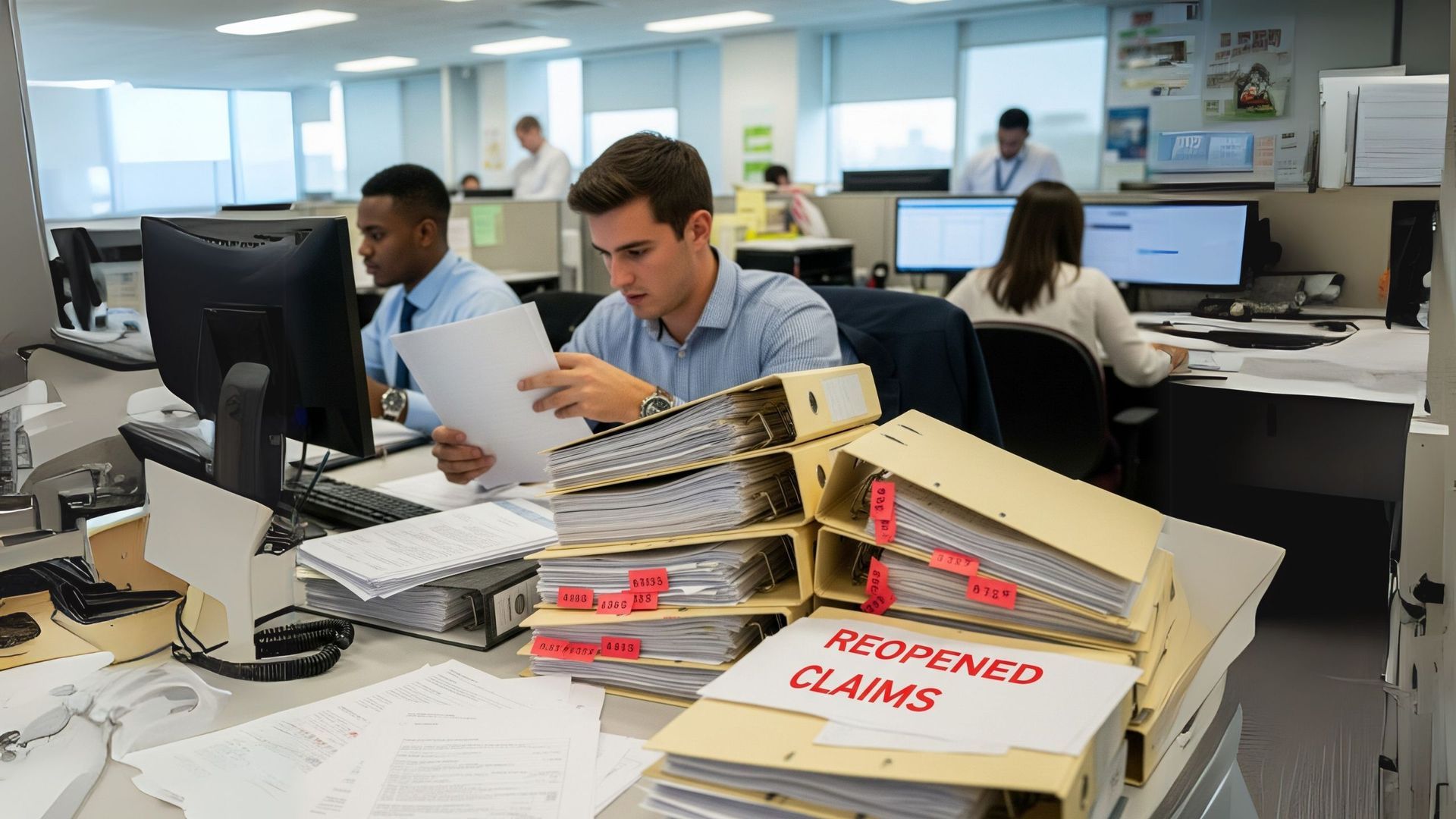

What slows down claims:

- Surface-level inspections that miss structural issues

- Reports lacking documentation or code compliance

- Disputes over scope, pricing, or repair methods

- Reopened claims that disrupt workflow

- Fast inspections after storms work only when they’re backed by qualified professionals who deliver clear, defensible evaluations from the start.

The Role of Forensic Engineering in Post-Storm Inspections

Forensic engineering goes beyond checking boxes. It helps determine:

- Was the damage caused by the storm?

- Is it cosmetic or structural?

- Are repairs temporary or full restoration?

- Is there underlying risk or code failure?

- A thorough structural evaluation by a licensed engineer helps carriers make informed decisions quickly—reducing reinspection requests and increasing policyholder trust.

How Fair Appraisals Protect Everyone Involved

When disputes arise, the appraisal process provides a path to resolution. But if the supporting documentation lacks detail or objectivity, the process can stall.

A fair appraisal process includes:

- Independent evaluation of damage and repair scope

- Neutral interpretation of repair costs and coverage

- Avoidance of unnecessary escalation or legal action

- Appraisal & arbitration services backed by accurate inspections help adjusters reach equitable outcomes and avoid costly litigation.

What Carriers Should Look for in a Post-Storm Partner

Not every inspection firm is built for CAT response. Insurance carriers should prioritize partners who offer:

- Rapid catastrophe response capabilities

- Experience in forensic engineering and code compliance

- Documentation built for carrier review and desk adjusters

- Qualified experts available for appraisal & arbitration

- With teams ready to deploy within Texas, Florida, Louisiana, and Georgia, Texas Piers Consulting supports regional and national carriers when it matters most.

Faster Claims. Fair Outcomes. Stronger Results

Fairness and speed are not opposites—they’re partners. When a carrier can resolve claims quickly and defensibly, everyone wins: the adjuster, the policyholder, and the business.